Today I read Paul Krugman writing about the paradox of thrift. As is often the case, I found it interesting to read and to notice the assumptions that Krugman bases his positions on. While anyone can go read what he wrote I’ll give a quick overview of the paradox of thrift – increases in personal savings can have an adverse effect on the economy causing a net decrease in actual savings overall.

The first assumption made by Krugman is that savings come in the form of currency with an assigned value but with no real intrinsic value – paper money. If savings come in the form of debt reduction or in acquiring real goods for future use then a bad economy increases the value of the savings rather than decreasing that value.

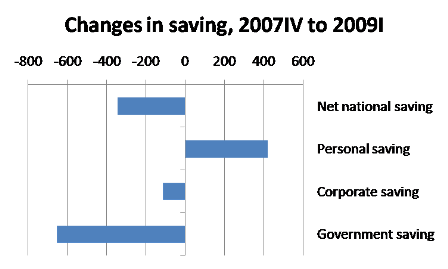

The second assumption made by Krugman is that government should be a significant force and substantial contributor to the economy. This is a man who argued that the government was doing the wrong thing and not enough of it when Obama got his stimulus bill passed (ARRA). While I often disagree with his assumptions I absolutely trust Krugman to be able to read the numbers and do his math so I won’t attempt to do my own numbers. I will link to the source of his numbers and then play with his graph to show how things look under new assumptions.

First, let’s see what the net savings has been over the same period if the government had not decided to intercede:

Saving without Government Intervention

Suddenly the net savings is extremely positive over the same period if we can assume that the bailouts and stimuli were not necessary or desirable. In other words, the paradox of thrift is “proven” by the fact that the government incurred more new debt than individuals were able to save.

On the other hand, what if the stimuli and/or bailouts were necessary or at least what if they had some positive effect on the economy? I’ll be generous to the government (and conservative with corporate efficiency) and imagine that the increase in government debt had twice as much positive effect on the economy than the decrease in corporate savings. (Anyone, even Krugman, would have to admit that government is not exactly a bastion of efficiency.) In that case, if we were to triple the decrease in corporate savings to offset the lack of our ever-burgeoning government debt while keeping the economy as stable as it has been so far we get this graph:

Corporate Debt to Replace Government Debt

Even if we are to accept everything we have been told about the economy and the necessity of intervention, the private sector could have accomplished as much as government without a net loss in total savings. Considering that the economy is as bad – after the stimulus and bailouts have had months to start working – as it was projected to be without those extra-constitutional efforts (remember that unemployment was not supposed to go above 8% after ARRA and it was supposed to get to 10% by the end of the year without it) I think we canse safely question much of what we have been told about the economy by people who are perpetually wrong as they “misread how bad the economy was.”

It’s the paradox of Keynesianism. If you use Keynesian policies to avoid the alleged paradox of thrift, you create the very thing you are trying to avoid.

Well said. (I like your post on the subject as well.)

Krugman is a smart guy, but his ideology always trumps his math. His continual support of big government based on macroeconomics belies the irrationality of his policy perscriptions. Even if he is correct that government spending and borrowing is desirable to supplant reduced private spending and borrowing during a recession, all such spending necessarily occurs in the least economically efficient manner according to the political payoff system rather than being matched with actual market demand. The damage caused by this action outweighs any supposed benefit.

The Really Smart People in the administration are already banging the drum for yet another stimulus. They are now agreeing with Krugman that the first stimulus was inadequate. The economy continues to suffer and unemployment continues to go up, not because the stimulus was a bad idea, but because it simply wasn’t enough. This is called a tautology and it is interesting to see how many Really Smart People buy it (or at least use it as an argument).

I am reminded of F.A. Hayek’s discussion in his book The Road to Serfdom of the hubris of technical experts that imagine themselves sufficiently capable and worthy of running the lives of the populace better than these individuals can run their own lives. But isn’t this exactly what we are doing with our government spending schemes?

The renowned Adam Smith wrote:

“The statesman who should attempt to direct private people in what manner they ought to employ their capitals, would not only load himself with a most unnecessary attention, but assume an authority which could safely be trusted to no council or senate whatever, and which would nowhere be so dangerous as in the hands of a man who had folly and presumption enough to fancy himself fit to exercise it.”

This aptly describes Krugman and his ilk.

I did not see the various reports bubbling up today touting the possibility or necessity of Yet Another Stimulus Package ™ until after I had written this. In my mind that just stands as further proof that they are making it all up as they go along and that they feel the need to continue headlong in their chosen course no matter the outcome lest they ever be forced to admit that they were headed in the wrong direction. I guess they subscribe to the philosophy that if you dig long enough you will eventually break through on the other side.

I think your quote from Adam Smith said it the best.